Against the backdrop of a turbulent international climate, the economic environment of Japan has entered an era of extreme uncertainty with inflation caused by soaring global raw materials costs and rising energy costs, as well as major changes to U.S. trade policy.

Joshin is part of the home appliances retail market, where the overall business climate has been subdued outside of replacement purchase-related demand, as there is currently a higher tendency to cut back on spending as a result of sluggish real wage growth due to inflation. In this second year of the JT-2025 Management Plan (hereinafter “the Medium-Term Plan”), Joshin’s performance fell well short of targets partly because of this tough economic environment.

However, our efforts since the last fiscal year to achieve more efficient asset management through increased stocktaking and other practices have enabled us to curb excessive bloat in asset holdings, while key indicators for our financial base show clear improvements, indicating that Joshin’s financial stability remains intact.

In particular, Joshin implemented several cash flow measures that resulted in increased operating cash flow and major improvements to free cash flow, ultimately enabling us to reduce our interest-bearing liabilities, which had been slowly growing.

Consolidated financial indicators (excerpt)

| (Million yen) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Our basic financial policy is to support sustainable corporate management through a solid financial base and efficient capital management. The three key points of our financial policy are as follows. The Medium-Term Plan uses ROE, ROA, and ROIC as its core management indicators.

|

1 |

Maintenance of a solid financial base |

|

2 |

Optimal allocation of operating cash flows |

|

3 |

Promotion of efficient management that is conscious of capital cost and stock price |

The Group views financial stability, an area in which we have previously been inferior to our competitors, as the foundation for corporate growth. In the previous medium-term management plan, we focused on building up capital with an aim to achieve an equity ratio of over 45%. Since FY2019, we have generally maintained this equity ratio level while also keeping the D/E ratio under 0.5.

Moving forward, we will continue to maintain a stable financial base that will serve as the key to our corporate growth.

資本効率指標

|

||||||||||||||||||||

Reference: Recent capital cost (based on our standards)

|

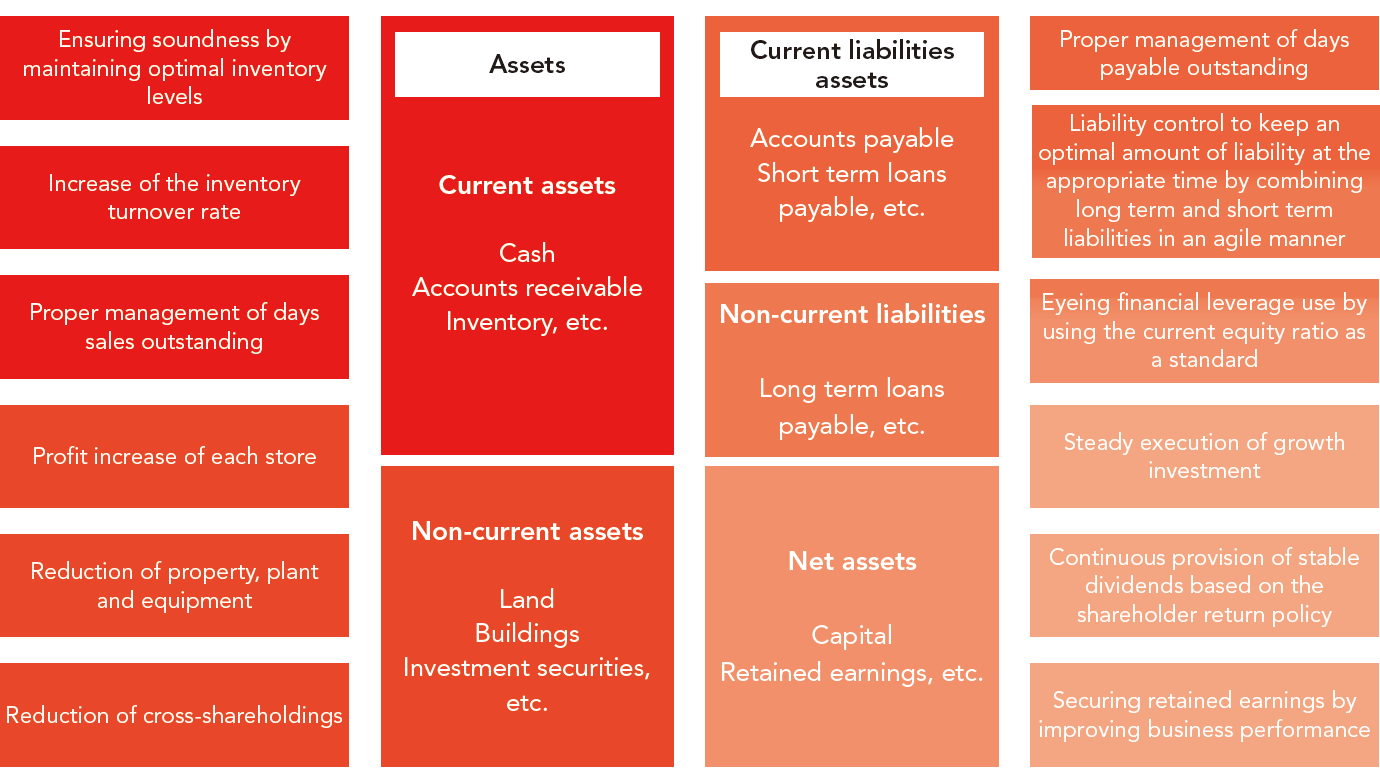

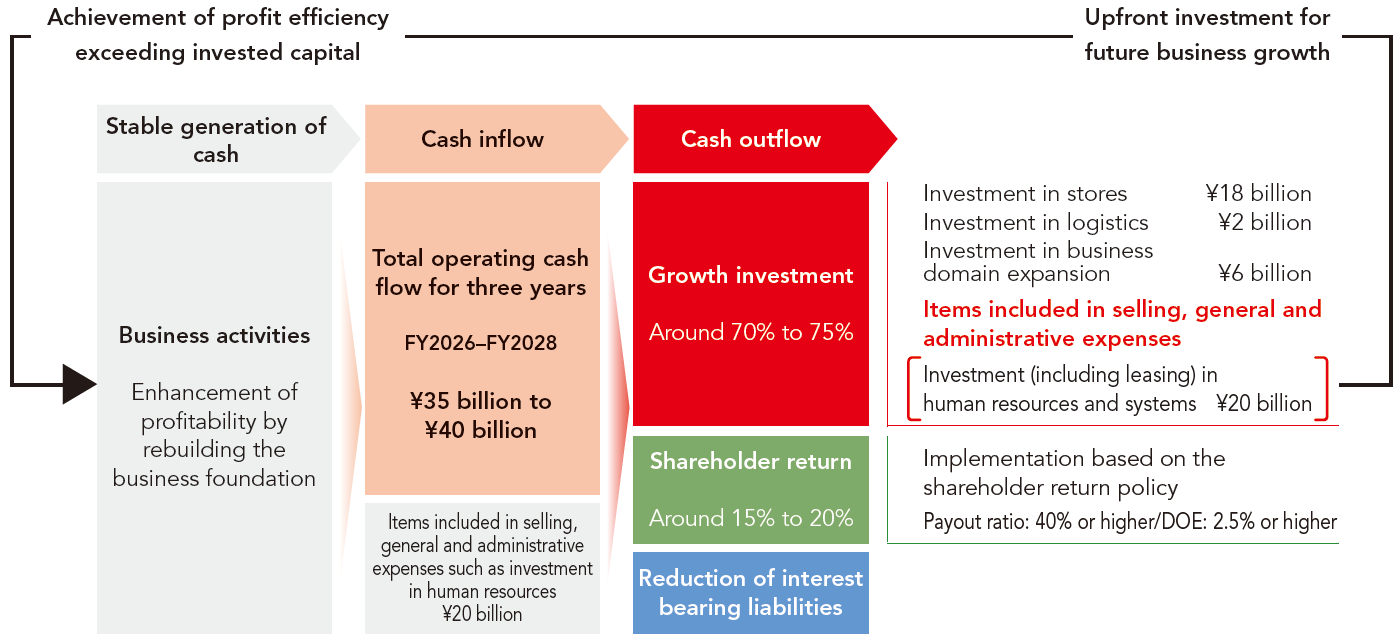

In the Medium-Term Plan, while still primarily focusing on growth investment for the future, we plan to allocate cash flows generated by businesses to shareholder returns and reduction of interest-bearing liabilities in a balanced manner, and work to optimize capital efficiency.

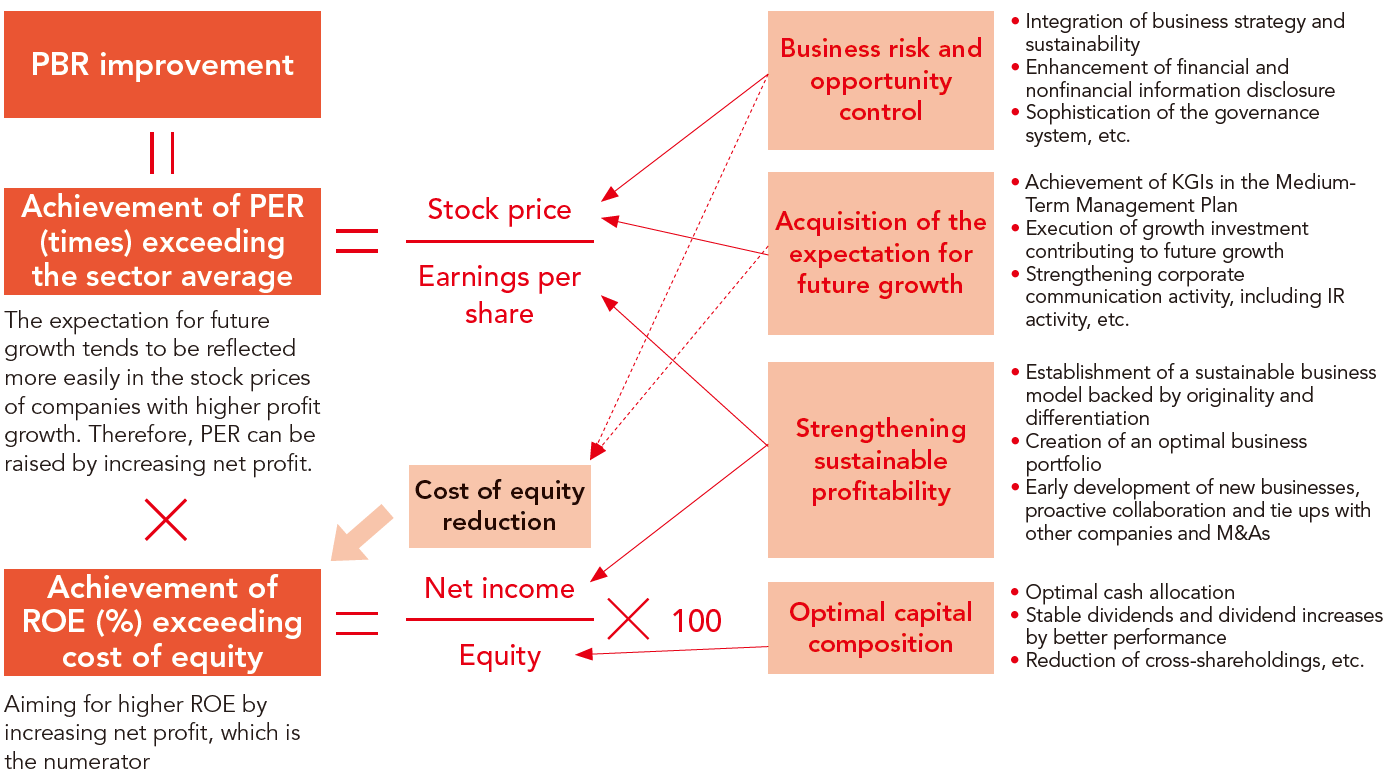

In order to achieve management that is conscious of the cost of capital and the stock price, Joshin will craft a story for the path ahead and apply that rationale to our various management initiatives. Furthermore, we will pursue deeper engagement with our shareholders and investors, and strive to manage our business such that we can push PBR over 1 (as of the end of September 2025, it is roughly 0.6) and ensure that we are favorably evaluated under the upcoming TOPIX reforms.

In our primary business of retail, our stores, equipment, deposits, and other investment assets have tended to weigh down our balance sheet (including cross-shareholdings, which are part of our business relationships).

Efficiently managing these assets to maximize earnings is one of the most important elements of our financial strategy.

We have worked to improve per-asset profitability by bolstering our standards for investment decisions, actively selling off assets judged to have low retained value while reinvesting in business growth and growth strategies, and cutting down on growing interest obligations by reducing our interest-bearing liabilities.

We are striving to achieve both more efficient asset management and improved financial soundness.

Vision for FY2028

|

Capital allocation in the Medium-Term Plan is based on the goal of generating operating cash flow of approximately ¥40 to ¥45 billion over a three-year period. Operating cash flow in FY2024 was ¥16.4 billion (totaling ¥18.7 billion for the first two fiscal years of the medium-term management plan), which was still short of targets, but we will maintain the current direction for future growth investment through appropriate financial leveraging and other means.

Specifically, at least 40% of this investment is assumed to be devoted to the shareholder payout ratio, with roughly 20% for operating cash flow and 70–80% centered on growth strategy investment into existing businesses, M&As, and improvements to service infrastructure.

The remainder will be used for reducing interest-bearing liabilities in order to maintain a stable financial base, as well as to improve ROE to enhance shareholder returns.

In terms of growth investment, we will continue to actively pursue human capital—an operating expense in terms of operating cash flow—in addition to actively pursuing system and DX-related intangible assets.

Vision for FY2028

|

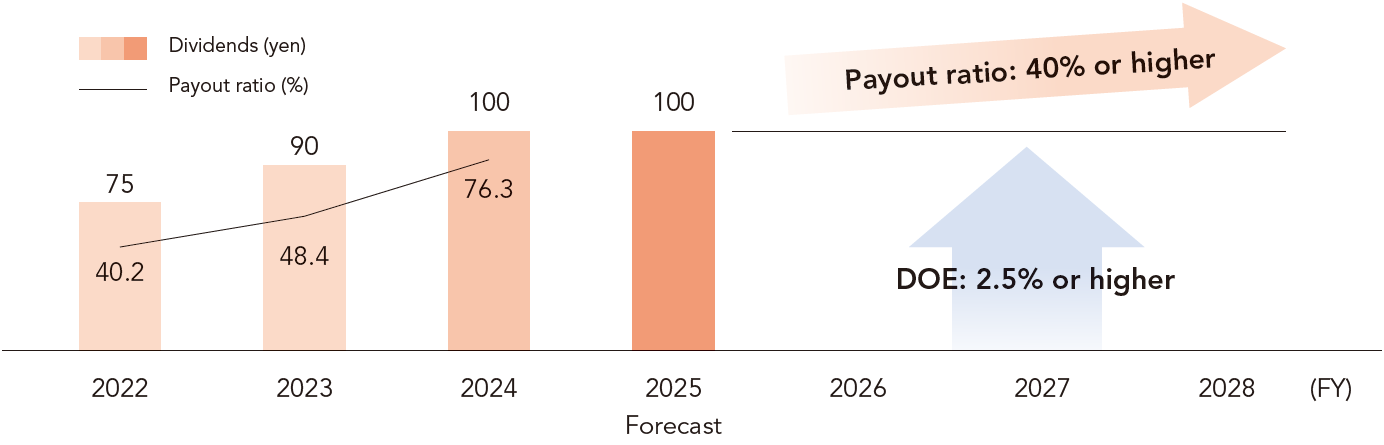

Joshin’s shareholder returns policy remains unchanged: to maintain consistent dividends while carefully considering

business results and the balance between dividends and internal reserves. In addition, we maintained the payout ratio of

40% or more, paying out ¥100 per share in FY2024 (payout ratio of 76.3%) (dividend was ¥90 per share in FY2023).

We also adopted a policy this fiscal year of paying out interim dividends (policy released September 16, 2025).

We will continue to consider shareholder returns a critical priority in the future, and in the JT-2028 Management Plan, we

adopted new metrics including a payout ratio of 40% or more and a DOE (dividend on equity ratio) of 2.5% or more. With the

adoption of the DOE, our basic policy will be to issue stable returns unaffected by performance fluctuations, although we

do aim to increase dividends as business performance improves.

(FY2024 share buybacks = 249 thousand shares ÷ 0.89% of outstanding shares)

Vision for FY2028

|

We seek to optimize our net assets, the core of capital allocations, through annual reviews, accounting discussions, and scrap-and-build strategies when appropriate. This strengthening of profitability in asset-based business activities will help grow EPS (earnings per share), and achieving this consistently will build expectations for future growth, raise PER (price-earnings ratio), and boost PBR (price book-value ratio).

Vision for FY2028

|

Joshin currently has relatively few outstanding shares (28 million shares), so setting up a bracket for share buybacks is unrealistic.

However, in the recent moves to reduce crossshareholding positions, there have been batches of shares sold off all at once in some cases, and in trying to strike a good balance with shareholder interests, we have also considered acquiring shares when expeditious to do so (250,000 share buybacks in FY2024).

As stated, we will continue to consider and work to optimize the payout ratio as one means of securing shareholder returns. Due to the number of outstanding shares, it is possible to be flexible with respect to dividends and there will be little impact on cash flow.

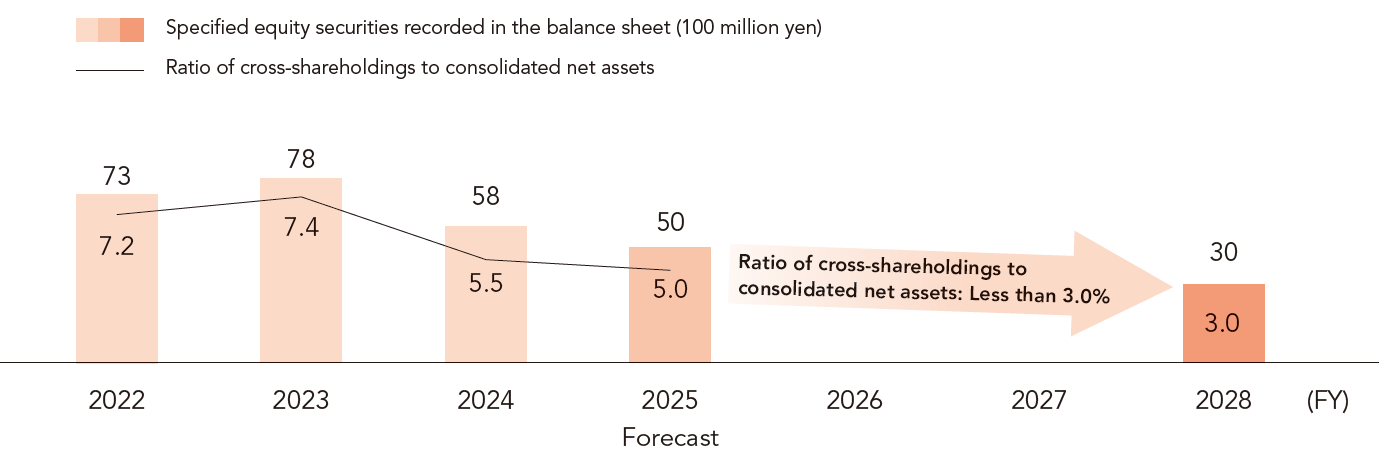

As stated in the Corporate Governance Report, we will be disposing of sellable shares as appropriate, with mutual consent with counterparties after repeated discussions that examine the purpose of holding such shares. In FY2024, Joshin recorded approximately ¥3 billion in gains from stock transactions including cross-shareholding and net investments, and this has played a role in improving final earnings. We will continue to engage in these activities from a capital efficiency perspective.

(As a rule, Joshin will not acquire new cross-shareholdings.)

(Moving forward, we will seek to reduce cross-shareholdings to less than 3.0% of net assets by FY2028.)

Vision for FY2028 Cross-shareholdings

|

Joshin is actively pursuing sustainable corporate management by building an optimized business portfolio and making strategic growth investments. However, we believe that investment decisions must be based on the premise of sustaining company-wide management metrics such as ROA and ROIC. Moving forward, we will continue to work with the Chief Officer for Sales Strategy to make active investments with a focus on efficient management.

In FY2025, we began moving to more effectively utilize the real stores that account for the majority of Joshin’s physical assets.

Specifically, we will strive to work through financial institutions and securities firms to collaborate with retailers beyond the home appliances sector to set up store-in-a-store vendors on Joshin sales floors to make better use of store space, generating synergies that will bring in more customers and help boost business for both parties.

The diversification of shareholders will be one of our most important themes moving forward. In IR activities as well, we seek to acquire a diverse body of “fan” shareholders regardless of the investors’ personal attributes or whether they are domestic or international. As a result of our steady work, the number of unit shareholders continued to increase as of the end of March 2025, growing by 4,252 people from the previous fiscal year (increase of over 20%, totaling 22,795 shareholders as of the end of March). Most of this increase was from individual shareholders, so it is expected to contribute to our efforts to build fans for our stores and e-commerce business (being as we are in the retail industry).

However, the ratio of overseas investors is currently only 7.64% (as of the end of March 2025), and we aim to more than double that ratio (to roughly 15%) over the medium term in order to improve our price-to-book ratio and improve liquidity as called for by the Tokyo Stock Exchange. In addition to disclosing materials simultaneously in English and providing information in a timely manner, generally all internal directors participate in individual investor relations meetings with institutional investors and others, whether online or face-to-face. After the transition to a company with an Audit and Supervisory Committee, all executive officers will also participate in such meetings. Through consistently candid, active engagement, we can benefit from a variety of new findings to inform future management decisions. Additionally, we actively set up opportunities to meet with securities analysts who cover the retail sector (to which we belong) and engage in discussions that will deepen those analysts’ understanding of Joshin’s unique qualities and differentiation strategy. We then utilize that in implementing management strategy that is mindful of capital costs and share price.

Also in FY2026, in preparation for the TOPIX reorganization beginning in earnest, we will be unwinding cross-shareholdings and having shareholders who previously held our shares on a fixed basis release those shares to the market instead, ensuring better liquidity as stock prices rise.

Going forward, as a company listed on the TSE Prime Market, we will continue to make growth investments that are even more proactive and conscious of capital efficiency, while maintaining a strong balance with improving shareholder returns. We will also further intensify our investor relations (IR) activities, and strive to be evaluated as a target for medium- to long-term investment by a wide range of investors.