In order to achieve Joshin’s management philosophy of “Connecting people and society to the future with a smile,” my mission is to make sure our customers become our fans and to maximize their lifetime value. To meet these targets, it is most important that we build unshakeable relationships of trust with our customers. Underlying that trust is Joshin’s “people”: all of our officers and employees.

To maximize customers’ lifetime value, we need to further enhance the capabilities of our human resources, including each and every officer and employee. By continuing to improve the capabilities of our human resources, getting more in tune with our customers, and providing value that exceeds their expectations, we will deepen our relationship of trust with our customers and create a better future.

The Future of Joshin’s Business

In the past, the market was growing, and it was clear how to make our business succeed. The key to success was expanding the number and size of our stores, and aiming to sell products as cheaply as possible. Today, however, the market is undergoing rapid change, and if we do not accurately identify our customers’ needs, our products will not sell. Successful approaches are becoming more complex amidst diversifying customer needs, and it is difficult to follow the traditional top-down approach. That is why it is increasingly important to draw out the true capabilities of the frontline personnel and foster innovation.

The front lines offer many insights into how to succeed, but there are limits to how much the front lines can accomplish alone. I believe that our most important mission in the management team is to pick up feedback from the front lines and turn that into concrete action, ensuring it takes root in the front lines.

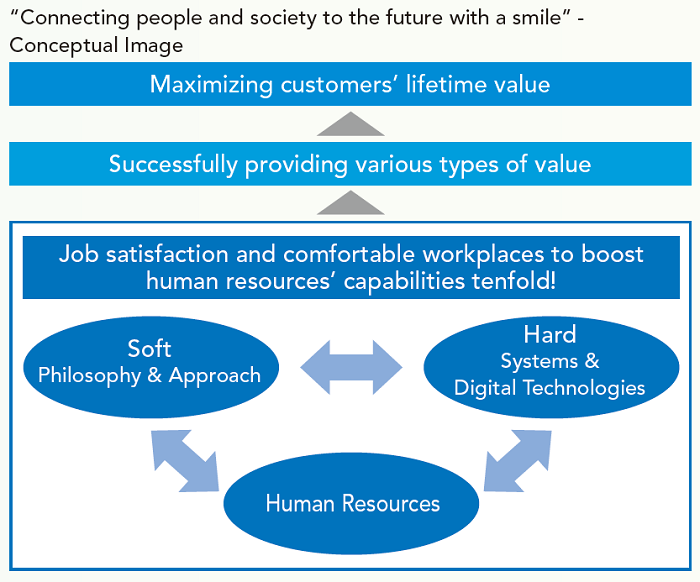

Building on a foundation of soft (philosophy, approach) and hard (digital technology) elements, Joshin will achieve comfortable work environments and job satisfaction to maximize the potential of our most important asset, our human resources, while aiming to secure strong sales.

In order to fully utilize feedback from the front lines, it is essential that upper management take the initiative to reform old ideas and ways of thinking. We will bring together all Group employees and create new, future-oriented value with the aim of achieving sustained growth.

Passion for the Home Appliances Business

I first joined Joshin because I love customer service. However, I do remember feeling uncomfortable, wondering if I could really sell these products that cost hundreds of thousands of yen. The more I worked at stores doing that kind of work, the more passionate I became for the job. That is because my efforts to listen earnestly to customer feedback and respond to requests led to more customers requesting me personally and gave me a wide range of connections. I valued the relationships I built through conversations with customers, and this led to a stream of new relationships. As I gained more connections like this, I built relationships of trust that led customers to introduce me to yet more customers. My desire to build this sort of environment is still where my roots lie today.

I have always said, “Our true goal should be to maximize customers’ lifetime value.” I hope to continue sharing this philosophy throughout the Company and beyond. We aim to maximize customers’ lifetime value by building relationships of trust with them and thereby increasing the number of customers who will buy Joshin’s products again and again. Homes will always have durable consumer goods like washing machines and refrigerators. Joshin strives to provide our customers with opportunities to discover good household appliances that will help them attain more convenience and comfort. We also aim to be a company that sticks by and supports our appliances for their entire useful life.

Aiming to Build a New Home Appliance Retailer Model with the Change in Name to “Joshin Corporation”

Joshin aims to transition into a flexible organizational structure that moves beyond “appliances” to include the creation of two social values, “helping to strengthen the resilience of an aging society” and “achieving household carbon neutrality,” as drivers of sustained growth and corporate value for the Group. As we flexibly adapt to a rapidly changing business environment, we decided to shift to a management structure that transforms these changes into strengths that drive growth. To that end, on April 1, 2026, we will change our name to the Joshin Corporation to be more aligned with the sort of company we seek to be and the future we aspire to achieve. We all understand that the current home appliance retailer business model will not work for the market of the future.

If I were to express Joshin’s path in terms of the Shuhari martial arts approach, the “Shu” (Protect) is our founding philosophy, the “Ha” (Detach) is our leading home appliances business, and the “Ri” (Separate) is challenging ourselves to new fields that build on the home appliances business. “Shu” (Protect) is our core that should never be changed, while “Ha” (Detach) represents corporate transformation and “Ri” (Separate) represents corporate innovation. We must achieve innovation through these processes and then create new value.

What must never be changed are the universal values we have developed since our founding. In other words, we must maintain our good relationships with our customers. On the other hand, something we absolutely must change is the home appliance retailer business model, creating something new by combining the value we have always delivered with the digital technologies that will be essential in the future. Through this, we will contribute to society by creating a new business model for the future.

To build a unique Joshin business model, we need to reexamine our current systems, recognizing that we have a mature business and considering how it can transform moving forward. My view on our basic strategy is to preserve the core of our business while embracing change to create a new form of home appliances business.

For example, when a customer purchases a new refrigerator or air conditioner, that begins a relationship starting from installation that often lasts over a decade. By standing alongside customers throughout those years and nurturing a deep sense of trust, we aim to continue to be useful as a company to both customers and local communities. This philosophy also aligns with our “JT-2028 Management Plan” (hereinafter “New Medium-Term Plan”; see p. 23). Treating the home appliances business seriously and cherishing it enables us to accurately identify both customer needs and the broader needs of society. This, in turn, opens up prospects for new lines of business.

The business model we aspire to achieve is a local electronics store that is also a mass retailer, but taken to a mass retailer scale. This means we should be a trusted, essential presence rooted in the community, supporting customers’ everyday lives. Carrying on and advancing that approach is the core mission of the new Joshin.

If we were to compare home appliances to a “tree,” they would be like a strong trunk rooted firmly in the ground, enriching the lives of people in the community. Business shoots out from that trunk like branches containing infinite possibilities. We are not merely a company that sells products. By listening closely to each and every customer and providing attentive, personalized service, we continue to stay deeply in touch with the daily lives of the communities we serve. That approach represents both the mission of a neighborhood electronics store and the conceptual ideal that Joshin strives to achieve.

To continue being an indispensable presence in local communities moving forward, Joshin will continue to grow and expand new branches and leaves around the trunk of our home appliances business. We aspire to be a warm and trusted neighborhood electronics store that is capable of meeting any need at any time. Guided by this philosophy, we are taking our next step forward.

I hold a steadfast belief that “a retailer that cannot win in the home appliances market cannot succeed in any other market.” Challenging ourselves to push the home appliances business forward will serve as a bridge to new business opportunities. By fully harnessing the capabilities of our employees and deepening our relationships with customers, turning them from “fans” into “core fans,” we aim to achieve sustainable growth. The driving force behind this is our employees, and I believe it is essential to achieve a balance that includes a comfortable work environment and job satisfaction. By building on a foundation of soft (philosophy, approach) and hard (digital technology) elements, Joshin is creating an environment that enables every employee to perform at their very best.

Furthermore, I believe it is the mission of upper management to establish a framework that enables proactive sales styles. However, resources like employees and stores are finite. We aim to resolve this by using online tools to improve operations and develop new services. Specifically, we will create a system that enables the expertise of individual employees to be shared online and utilized across multiple stores. We also intend to enable customers to use their smartphones to obtain price quotes and diagnostics for home appliances, helping to resolve many issues and deliver even better service.

Now that we have launched under a new management structure, I want to send a powerful message: “we will compete not through size or scale, but through speed and quality.” We will steadily implement our action plan to make that vision a reality.

Overcoming Headwinds to Reach Rising Tides in the Home Appliances Business

The main reason that we are having difficulty achieving our current medium-term management plan “JT-2025 Management Plan” is that the home appliances business is undergoing a structural contraction. While we were unable to halt the downturn in company performance, our growth businesses of mobile communications and home renovation have seen steady growth. As for the entertainment segment, although it remains subject to the inherent volatility of a hit product-driven market, it still holds strong potential for dramatic growth if new products are launched. Our entertainment products enjoy strong customer support, and many of those customers also contribute to the sales of home appliances. In this way, the entertainment segment has continued to deliver stable growth as one of our core businesses and plays a vital role in supporting overall

performance.

However, we deeply regret that we failed to properly identify the gradual stagnation of the home appliances business as a critical issue and did not take appropriate countermeasures in response. Specifically, our focus on large appliances, which have a long replacement cycle of about 8 to 10 years, led to a decline in overall store visit frequency, a drop in our number of active members1, and an imbalanced rise in average spending per member. The cause of this problem is clear, so by strengthening product categories with higher purchase frequency and revising our category strategy, we can reverse the decline in active members and return to a growth trajectory. Moving forward, we will seek to stabilize the home appliances business through the use and enhancement of our CDP2, while building a company structure that allows us to add contributions from growth businesses.

- Active members: Customers who have purchased products or services from Joshin at least once in the past year

- CDP (Customer Data Platform): A platform for utilizing data on individual customers

Reviving and Transforming Home Appliances in the New Medium-Term Plan

As described above, the core of our New Medium-Term Plan is to revive and push forward the home appliances business. Our basic strategy is to revamp the home appliances segment while expanding our mobile communications and home renovation businesses. The strongest pillar of Joshin remains our home appliances business, and our greatest asset is our human resources. Building upon our most loyal customer base, the Kansai region, we aim to revive and transform the home appliances business and then expand that success to the Tokai, Kanto, and Hokushinetsu regions. We aim to leverage our two unwavering strengths—our leading business and our talented workforce—to connect them directly to our growth strategy. Although the home appliances business is often viewed negatively within the Japanese retail market due to it being a mature industry, it remains an enormous and essential market nonetheless. With the increasing normalization of severe summer heat in recent years, air conditioners have effectively become life-sustaining infrastructure, and the role of home appliances is entering a new phase of transformation. While our company ranks seventh in the industry, we believe that Joshin’s community-based dominant strategy leaves ample room for further business growth and expansion. It is crucial that we harness the universal value cultivated during good times of the past, such as the emotional value of maintaining trusted relationships with customers, while combining that with digital technologies to generate new functional value. The synergy of these two elements will enable us to establish a strong business model. Moreover, to become a company that customers genuinely want to “cheer for,” we ourselves must first become passionate fans of our customers. We must solve their problems, and build mechanisms across our entire organization to deliver those solutions, thereby creating a new kind of home appliance business model unlike any seen before.

From a financial perspective, we have designated ROE, PER, and PBR improvements as key performance metrics that we will work to improve to strengthen our financial soundness. With a base of over ¥100 billion in net assets, we will ensure growth in operating income, which is the source of net income, and thereby improve ROE. At the same time, we will improve our investor relations efforts to communicate our value more effectively. Our current “fan-based” business model has been built up over more than 75 years of Joshin history as a believer in wholehearted customer service, and it provides a distinct competitive advantage to Joshin over our peers. We will continue to strive to clearly communicate this message to our stakeholders to ensure they understand it more fully.

The New Medium-Term Plan was announced on November 4, 2025, coinciding with the release of our Q2 financial results. Announcing it six months prior to its official start, we have already begun implementing several priority strategies ahead of schedule. In this rapidly changing market, speed is at the core of competitive strength. We believe it is vital to accurately assess conditions, define our direction quickly, and move into action immediately. One factor that made this agile planning possible was our transition in June 2025 from a company with a Board of Auditors to a company with an Audit and Supervisory Committee. This change in governance structure was designed to enable faster executive decision-making and more effective oversight, and we are already seeing some benefits. Discussions at the Board of Executive Officers have become more dynamic, decisionmaking speed has increased, and through the Board of Directors’ oversight, management transparency has been enhanced as well. There are also more opportunities now to discuss medium- to long-term strategy, giving us a strong feeling of control over the direction of future business development.

Aiming to Gain More Fans and Core Fans to Maximize Stakeholders’ Lifetime Value

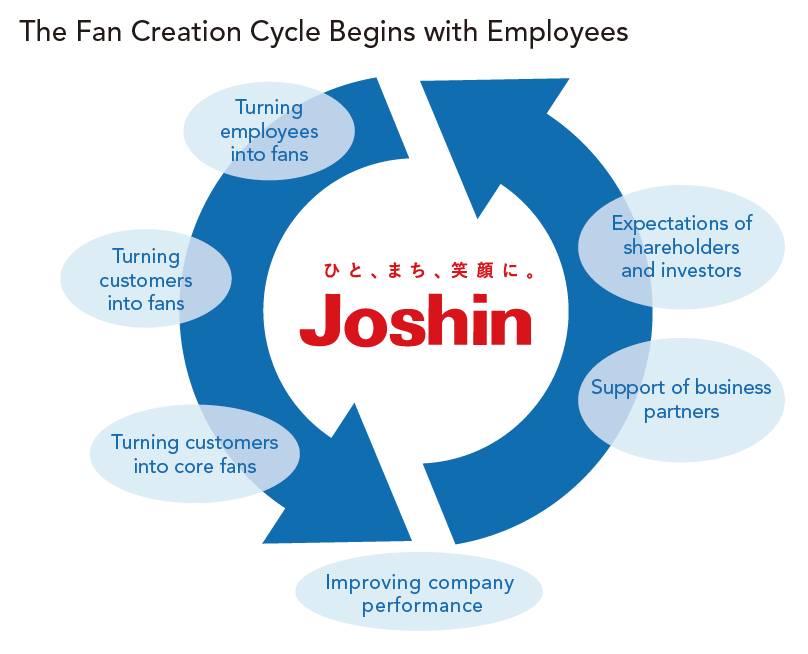

Moving forward, what I want to focus on most is turning all of our stakeholders into fans, and then into core fans. This includes our employees, shareholders, investors, customers, and business partners. Among these, however, I believe that the highest priority must be given to our employees.

Employees are the most important asset of any company. When that belief is clearly conveyed and understood, each employee becomes a source of strength that cheers on the Company. That enthusiasm naturally extends to our customers, leading to the growth of our fan base and ultimately to core fans as well. A company that is not loved by its employees will not be loved by its customers. A company that is not loved by its customers will not be supported by its business partners. And a company without such support cannot hope to meet the expectations of its shareholders and investors. Once this positive cycle begins, our fan community will naturally expand on its own and gain energy. The source of that energy will be the improvement of employee compensation through better company performance, as well as the creation of shareholder

value through stock prices, dividends, and shareholder benefits. Achieving growth as one team requires sustainable business expansion. Fostering employee ownership improves engagement, and by reflecting that in our company performance, we will guide the entire company onto a growth trajectory. Joshin will celebrate our 80th anniversary in FY2028, the final fiscal year of the New Medium-Term Plan. We will achieve our targets by steadily executing the policies outlined in this plan, and then move on to new challenges in the next stage. We will embrace change and challenge ourselves without fear to fulfill our responsibilities to the future, and we will dedicate ourselves wholeheartedly to creating new value. To all our stakeholders, we sincerely ask that you look forward to the future of Joshin.

While valuing the trust we have built and our community-oriented mindset, we aspire to create new value through the fusion of “mass retail” with the “local electronics store.”

Centering on our diverse touchpoints including physical stores, e-commerce sites, and service infrastructure, we aim to be more closely connected to life in local communities, addressing the needs of each and every customer at every stage of their lives.

By building up this community-based “Joshin economic zone,” we strive to grow into a lifestyle support company.

Carrying On and Evolving Wholehearted Customer Service

Since our founding, Joshin has cherished our Corporate Credo of “Thoughtfulness,” (always acting in consideration of others’ perspectives) and incorporated wholehearted customer service into all of our customer interactions. In every service we provide, from customer service and delivery to construction, installation, and repairs, each and every Joshin employee strives to embody kindness and attentiveness to ensure that customers can truly feel that human warmth.

This core company DNA will remain unchanged, passed on from one generation to the next as the human touch that no technology can replace, while being enhanced through modern technologies and services suited to the times.

Becoming a Lifestyle Hub Attentive to Community Feedback

Rather than pursuing nationwide expansion, Joshin has focused on deeply rooting ourselves in the Kansai region, specifically to develop stores closely intertwined with the daily lives of local residents.

Our mission is to pick up on the problems and needs of each community and provide tailored responses that serve their diverse lifestyles and daily living needs, which differ from town to town.

Going forward, we aim to be trusted as an infrastructure of life by all generations, from children to seniors, not only through our real stores but also through points of contact such as e-commerce sites and mobile apps.

Evolving Services that Utilize Digital Technologies

Joshin strives to provide new forms of value beyond conventional home appliance sales. These include utilizing AI and digital technologies to provide remote construction cost estimates and repair diagnostics, same-day repair services, custom renovation projects for changing lifestyles, smartphone maintenance, and monitoring and security services.

Combining the convenience of a large retailer with the approachability of a local electronics store, Joshin continues to develop products and services for every stage of life, adapting to changing lifestyles while always remaining closely in touch with their daily realities. Together with our communities, we will build this future.