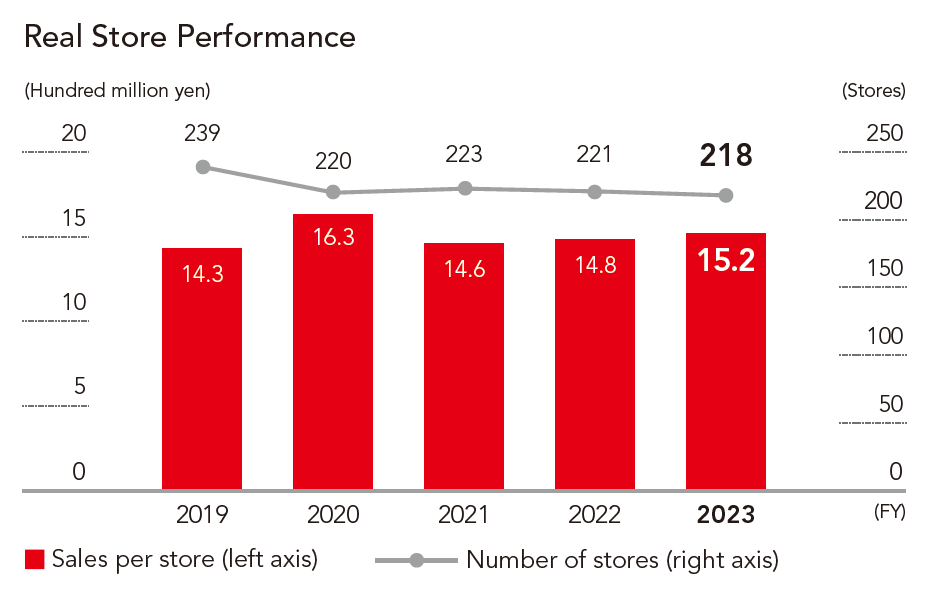

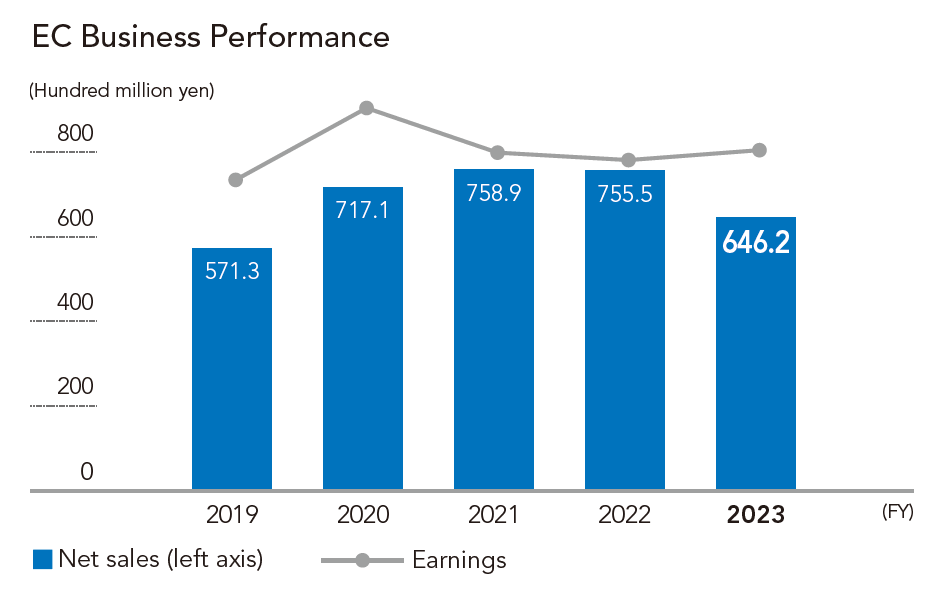

Fiscal 2023 continues a three-year trend of plateaued sales, a rebound from fiscal 2020 that saw strong performance from extraordinary demand created by the COVID-19 pandemic and cash subsidies. However, sales at real stores are reliably growing. While the number of appliance stores remained the same as last year, per-store sales grew from 1.48 billion yen in fiscal 2022 to 1.52 billion yen in fiscal 2023, so it is believed initiatives to strengthen sales capabilities are bearing fruit. Gross profit margin also grew from 25.4% in fiscal 2022 to 26.0% in fiscal 2023. Our restructuring initiatives aimed at strengthening the profitability of the EC business saw a drop in sales but improvements to operating income ratio and sales volume, which is believed to be a good sign for the future.

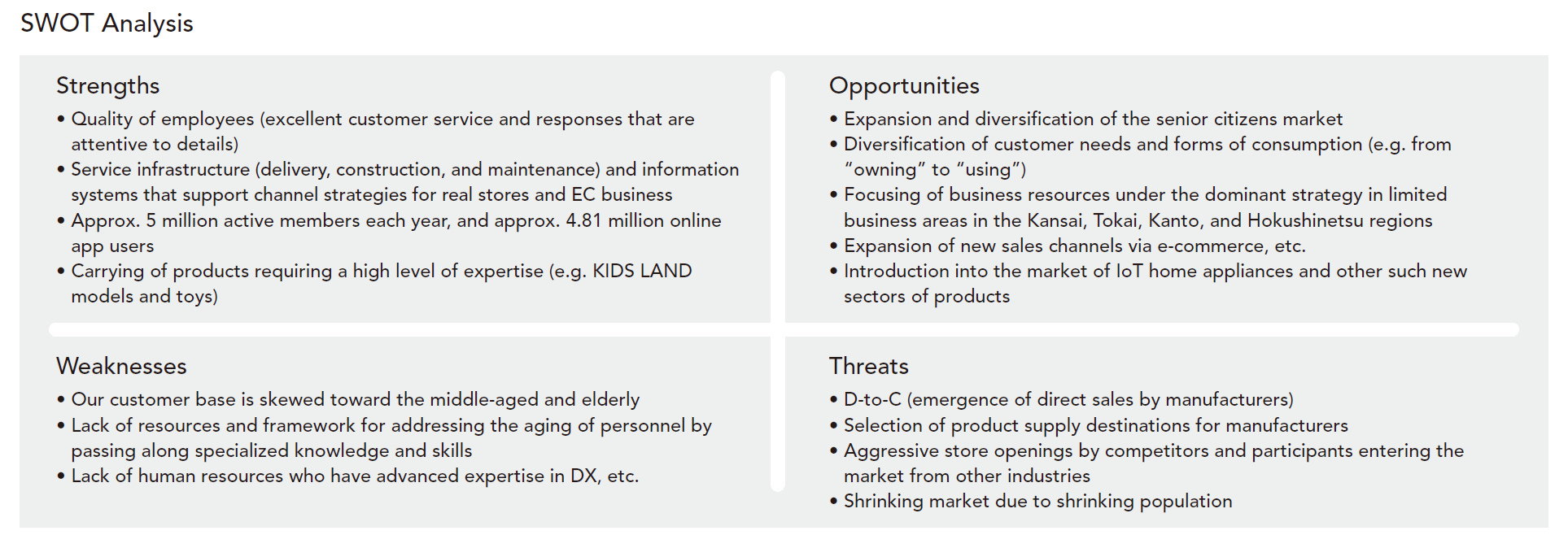

With the shrinking working population associated with overall population decline, the 2024 problem in logistics and other regulation-related issues, and changing customer needs as Japan becomes a super-aged society, we must expect that Joshin’s market environment will continue to change a breakneck pace. An important point moving forward will be how we link our business strategy to the economic strategy aimed at a “virtuous cycle” of rising wages and prices, and whether we can bring more consumption to the home appliances business.

Assuming that individual consumers replace their home appliances in the 50 years between ages 20 and 70, an individual will buy a replacement of an appliance six times for long-lifecycle products (assuming a 10-year period of use), or 12 times for short-lifecycle products (assuming a 5-year period of use). This approach to buying a replacement of home appliances has increased along with increase of the senior citizens’ share of the population, leading to an increase in customers who seek out truly necessary and valuable items, with a price that represents a cost needed to ensure value. Along with this, there have also been changes in young people’s approach to home appliances as they have watched their parents growing up. Changing values and awareness can be seen in diversifying needs, such as how modes of consumption have changed from an emphasis on “ownership” to an emphasis on “use” through subscriptions and other paths. These changing attitudes have also led to changes among creators and sellers, and there may be major changes to the form of the market, from manufacturing to distribution. To tackle these changes, we offer support businesses such as reuse and rental services in addition to our main home appliance sales business, and we hope to actively challenge ourselves to new fields in the future as well.

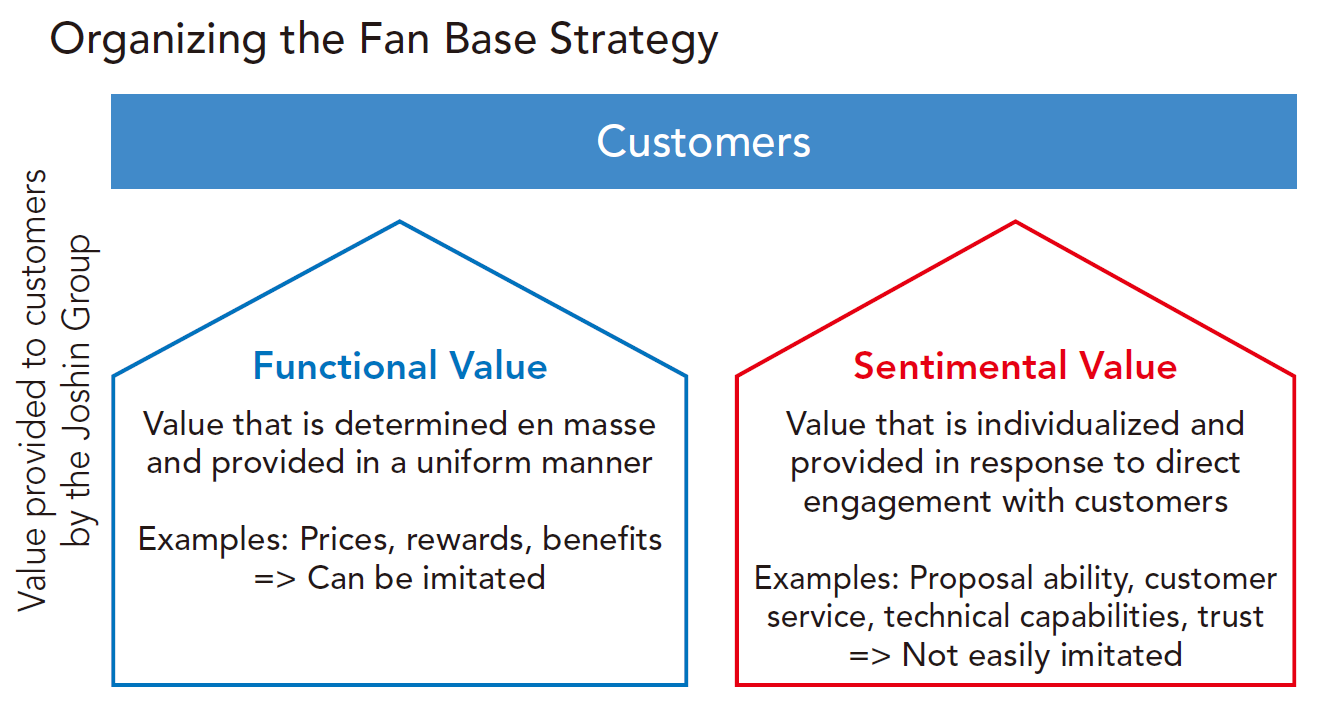

The Joshin Group began working on the new medium-term management plan (“JT-2025 Management Plan”) in fiscal 2023. The theme of the new medium-term management plan is to become a “concierge to customers, drawing close to their daily lives” as we work to strengthen profitability, or our ability to generate profits, through growth rooted in quality rather than the conventional quantity. In growing a business, it is essential to strike a balance between quality (sales capabilities) and quantity (number of stores and sales floor area), and we believe that improving “quality” is the top priority. Improving quality means the Joshin Group’s goals to improve profitability, profit structure, and revenue base. The new medium-term management plan aims to increase “quantity” only once “quality” improvements are ensured. At the core of our plan is the fan base strategy, which refers to Joshin’s sales strategy itself, rooted in our corporate credo of “Thoughtfulness” that has been continuously passed down within the Company since our founding in May 1948. We aim to redefine these concepts based on the fan base approach, providing two types of value — the sentimental value we have amassed over time (trust, reliability, stability) and a more functional value that combines digital capabilities to be more attuned to customers (provision of various information; timely proposals). Through these two types of value, we aim to become a company that “supports growth of the local community and contributes to both individuals and the future.”

“Fan base” refers to the management philosophy that Joshin has cultivated since our founding, and the fan base strategy refers to our initiatives to see that philosophy become reality. The fan base strategy is our ability to continuously provide an advanced form of value that has its origins in a deep understanding of what customers expect “before the purchase,” “during the purchase,” and “after the purchase.” While working to enhance products and service content to serve customers’ individual needs, the biggest factors for the pre-purchase stage are “information provision and solution proposals,” for the purchase stage they are “price and solution proposals,” and for the post-purchase stage it is “after-sales service.” The foundation at all stages is our customer service capabilities. At the Joshin Group, information provision is the responsibility of the Sales Promotion Department, prices are the responsibility of the Merchandise Department, solution proposals are the responsibility of the Sales Department, customer service is the responsibility of the CS Promotion Department, and after-sales service is the responsibility of Joshin Service Co., Ltd. Our information systems provide the platform underlying all of this, and that role is covered by the Information System Department. Each department implements measures with an awareness of the “fan base,” and collaboration among sections as well as maximizing value provision out of each section together constitute what we consider Joshin’s fan base strategy.

Diligently pursuing customer service for each and every customer, we develop our core customer base of clients who recognize the value that the Joshin Group provides. Whenever customers return to Joshin to use our services, or when they go beyond that and actually recommend the Joshin Group to others, that activity helps to generate new customers for us. The generation of a chain of “fans” in that way is a major objective of our fan base strategy.

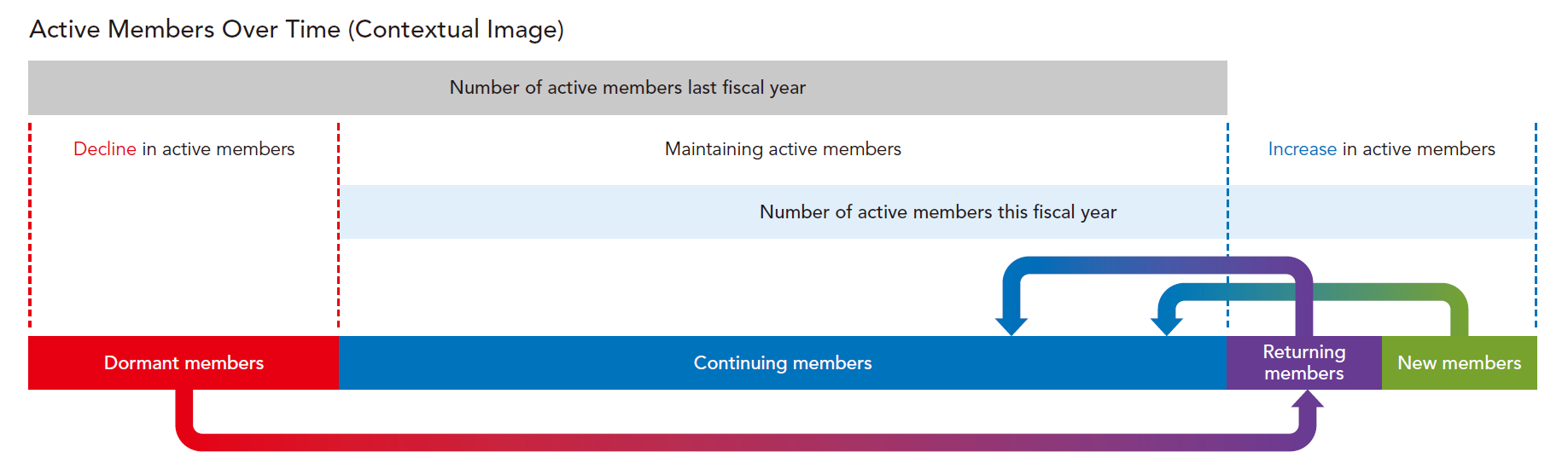

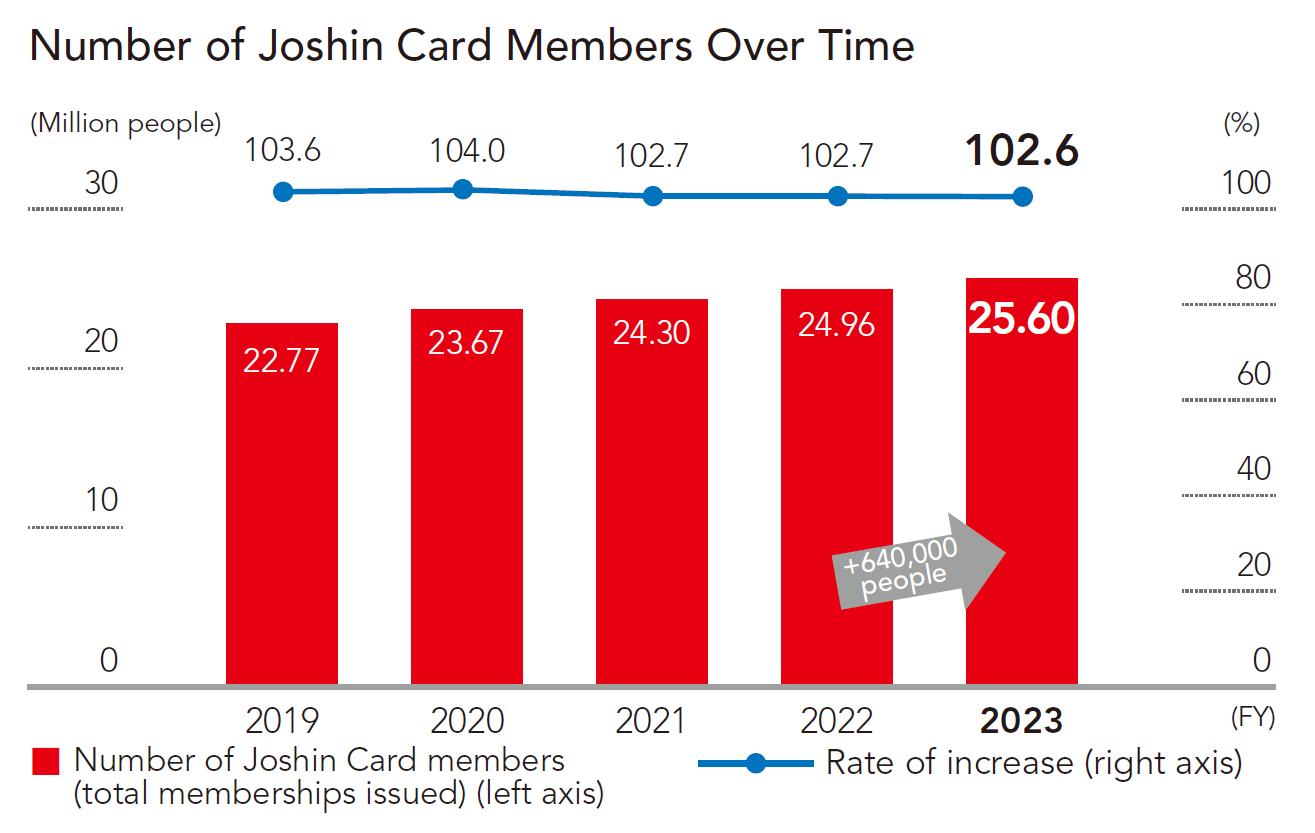

In February 2024, we launched a new customer loyalty program called the “Joshin Smile Program.” In this program, we classify our top-ranked members in terms of annual store visits and purchase amount as VIP “core fans,” while platinum members and gold members are “fans,” as we announced last year. We keep an eye on our active member count (members who used Joshin services in the last year), annual number of store visits, and annual purchase amounts over time and use this information to bolster our initiatives under the fan base strategy. Since household appliances are durable consumer goods that are replaced once every several years, there are some cases in which a customer defined as a “fan” based on their consumption behavior is nonetheless excluded from the active member count. To that end, we monitor our customers in terms of a range of background metrics and factors rather than simply pursuing absolute numbers.

The diagram below aims to depict the development of active members over time. Active members are calculated with continuing members as the base (1) plus the total of new members and returning members (use by members who have not used the service in at least one year). On the other hand, (2) factors pushing in the other direction include dormant members who have not used the service in a year. The difference between (1) and (2) represents the cause of an increase or decrease in active members. Picking up the pace on store openings will lead to an increase in new members, but if the pace of new store openings is too fast, there will likely be problems maintaining a high level of quality in customer service, which in turn leads to growth in the number of dormant users. The Joshin Group focuses on “quality” in our sales activities, and a steadily increasing number of members are coming back as returning members after having become dormant members. We believe that combining this quality with the “power of numbers” (quantity) will be what increases our active member count.

The growth strategy that the Joshin Group aims to implement is focused first and foremost on improving quality, and only upon satisfying that prerequisite do we aspire to growth via quantity or to taking on the challenge of pursuing new lines of business. “Quality” refers to customer service quality, and it is human resources that are absolutely the most important requirement to ensuring both quality and quantity. Failure to build the required company environment to support a rapid increase in store count, sales floor area, and product lineups may damage human resources and potentially stifle growth. Ultimately, it is important to strike a balance between quality and quantity, and we believe that a fan base strategy focused on maximizing the quality provided to customers will lead to growth in the numbers of gold and higher members as well as growth in active members. The value provided by the Joshin Group at the pre-purchase, time of purchase, and post-purchase stages includes both functional value and sentimental value. Functional value like prices and loyalty points can be imitated by competitors, but sentimental value is unique to the Joshin Group and therefore not easy to imitate. Examples of sentimental value include: 1) proposed product solutions that the customer will never regret accepting; 2) customer service capabilities that provide each customer with customized solutions; and 3) technical capabilities and trust that we have developed through installation and construction work performed at customers’ homes since our founding in 1948. Through these strengths, we aim to push the fan base strategy ever further ahead. In order to cherish our customer relationships and ensure their everlasting loyalty, we hold regular Joshin Fan Meetings to strengthen those relationships with Joshin fans and core fans, and since fiscal 2024 we have systematically organized a “fan community.” We also hold the Joshin Customer Service Roleplaying Contest targeted at sales personnel at stores among other initiatives aimed at strengthening the creation of sentimental value. In addition to customer purchase history information, we have also begun collecting customer behavioral data for the pre-purchase, time of purchase, and post-purchase stages and utilizing marketing automation with the aim of providing “fan” and “core fan” customers with timely information. By combining sentimental value and functional value, we aim to achieve a higher level of value provision for our customers.

We aim to have the Joshin Group fan base include not only customers but also employees, business partners, shareholders, investors, and all other stakeholders as fans. Our business partners, in particular, are the stakeholders who sustain our businesses themselves, and so we strive to respect one another as we grow our business on fair and equal footing with one another in all things. By having shareholders and investors become fans and customers who shop at our stores with shareholder rewards, we aim to improve performance and thereby achieve dividends that satisfy expectations, boost our stock price, and improve PBR as called for by the Tokyo Stock Exchange (TSE). To that end, we must create a virtuous cycle within the Joshin commercial zone and secure more investment. The fan base aims to transform all stakeholders into fans and core fans, without being restricted to just customers alone.

At the core of the Joshin Group’s business strategy is home appliance sales, which goes to our founding roots, and we do not expect any major changes in this on the path to 2030. Based on home appliance sales and our highly original, highly specialized entertainment business developed through the KIDS LAND brand, the Joshin Group’s growth strategy is to tackle business areas in which we have a high affinity and add these to our lines of business by means of expansion. These high-affinity business areas include the renovation, mobile communications, and support businesses. In fiscal 2023, these business areas accounted for 14% of sales and almost 10% of net sales growth, and we expect to grow them into “core” businesses that will drive the entire Joshin Group in the future. In home appliances sales, rather than pursuing large expansions, we have instead used existing assets to enhance profitability. In order to enable our customers to lead more enjoyable, more comfortable, and more enriched lives, we work to propose a diverse range of solutions customized to customers’ problems in order to contribute to solutions to those problems.

The Joshin Group’s “dominant strategy” is to fuse our EC store business with our store network spanning the Kansai, Tokai, Kanto, and Hokushinetsu areas. Of the EC-compatible products as of fiscal 2024, we expanded support for store pick-ups to all products other than CDs/DVDs and large-sized products, whereas previously store pick-ups were only available for a limited inventory. We also began offering home delivery services for large-sized products and recyclable products outside of local store areas. These initiatives were achieved thanks to the Kansai Ibaraki Logistics Center, which started operation two years ago, as well as the expansion of the Tokyo Logistics Center, and the full-fledged launch of the two-hub east/west logistics framework. In this way, we have built a foundation for the dominant strategy to play out. Meanwhile, our wholly owned subsidiary Joshin Service Co., Ltd. has established new offices in six Kansai area prefectures in order to rebuild our service personnel framework for providing on-site repairs. At present, our methods of tackling individual problems aim to include fault diagnoses and cost estimates utilizing online service technology, as well as new systems and business creation that will generate social value and resolve customer issues by listening to customers’ requests and expectations.

These platforms that underlie our business strategies are information systems. This platform-building is making steady progress, and while we will of course further strengthen core businesses with a focus on home appliances, we will also use this to drive ahead our renovation business and other growth businesses while helping to create new businesses as well. With our existing businesses at the core, we will add growth businesses alongside on the same track, and transform our entrepreneurial mindset towards creating new businesses into energy for growth.